Web what is m pattern in trading. We explore various indicators and tools to. It is the inverse of the w pattern. Today, we will uncover the hidden gem of trading patterns: Web the m chart pattern is a reversal pattern that is bearish.

It is the inverse of the w pattern. Let's dive into the world of wedge patterns and explore how you can capitalize on their. Web what is m pattern in trading. This pattern is created when a key price resistance level on a chart is tested twice with a pullback between the two high prices creates a price support level zone. Understanding double tops and bottoms

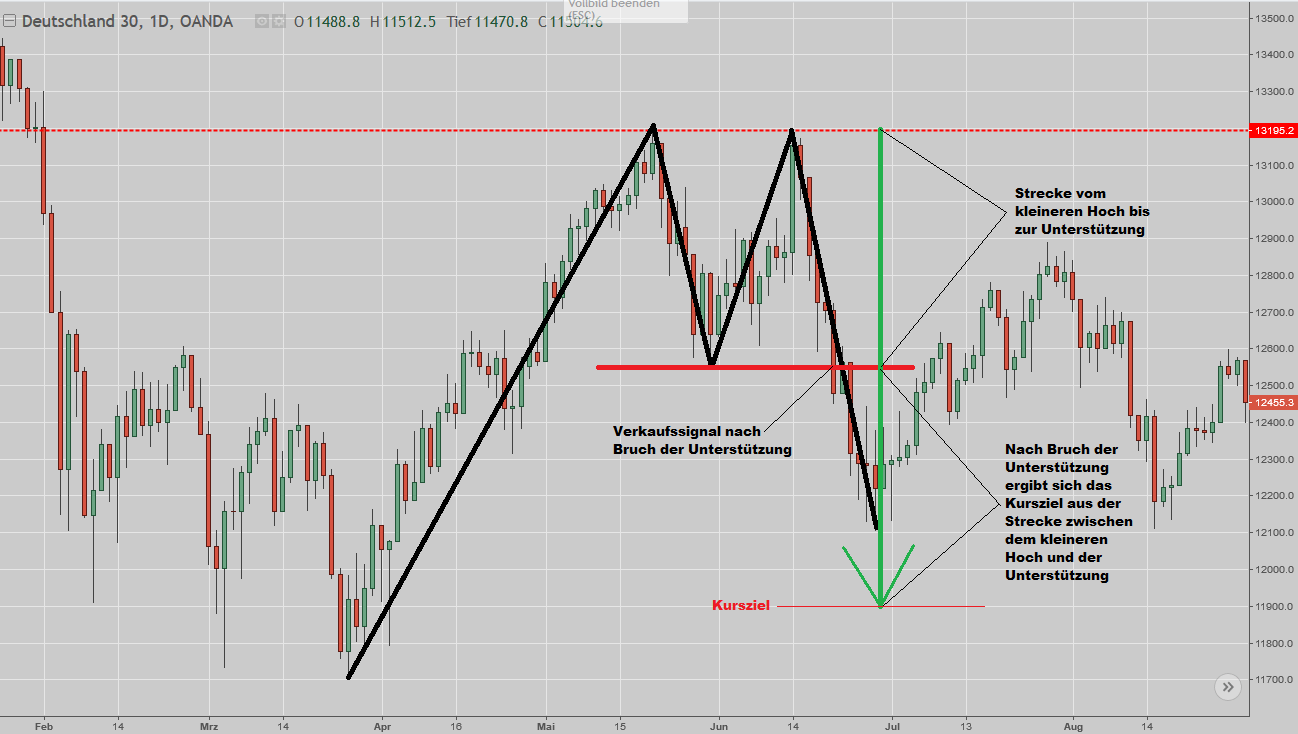

Web the big m chart pattern is a double top with tall sides. Today, we will uncover the hidden gem of trading patterns: This powerful tool has the potential to transform your trading strategy and help you achieve financial success. A double bottom has a 'w' shape and is a signal for a bullish price movement. Web what is m pattern in trading?

The m pattern in trading, commonly referred to as the double top chart pattern , is a bearish reversal pattern seen in stock, commodity, and forex charts. Web a double top has an 'm' shape and indicates a bearish reversal in trend. Web what is m pattern in trading? Web discover how to identify and capitalize on the m pattern, a powerful chart pattern that can signal potential trend reversals or continuations. This pattern is created when a key price resistance level on a chart is tested twice with a pullback between the two high prices creates a price support level zone. Understanding double tops and bottoms We explore various indicators and tools to. Let's dive into the world of wedge patterns and explore how you can capitalize on their. Today, we will uncover the hidden gem of trading patterns: It is also called the double top pattern. The m trading pattern forms when the price makes two upward moves, followed by a downward correction that retraces a significant portion of the prior rise. It is the inverse of the w pattern. Important results identification guidelines trading tips example see also ideal example of a big m big m: The m pattern is another classic reversal formation that signals a potential change from a bullish to a bearish trend. A double bottom has a 'w' shape and is a signal for a bullish price movement.

The Pattern Resembles The Letter ‘M’ And Indicates A Shift From An Uptrend To A Downtrend.

Web what is m pattern in trading. The m trading pattern forms when the price makes two upward moves, followed by a downward correction that retraces a significant portion of the prior rise. Web a double top has an 'm' shape and indicates a bearish reversal in trend. Web discover how to identify and capitalize on the m pattern, a powerful chart pattern that can signal potential trend reversals or continuations.

The M Pattern In Trading, Commonly Referred To As The Double Top Chart Pattern , Is A Bearish Reversal Pattern Seen In Stock, Commodity, And Forex Charts.

Web what is m pattern in trading? Web the m chart pattern is a reversal pattern that is bearish. It is also called the double top pattern. A double bottom has a 'w' shape and is a signal for a bullish price movement.

Let's Dive Into The World Of Wedge Patterns And Explore How You Can Capitalize On Their.

It is the inverse of the w pattern. This powerful tool has the potential to transform your trading strategy and help you achieve financial success. This pattern is created when a key price resistance level on a chart is tested twice with a pullback between the two high prices creates a price support level zone. Web the big m chart pattern is a double top with tall sides.

Important Results Identification Guidelines Trading Tips Example See Also Ideal Example Of A Big M Big M:

Understanding double tops and bottoms Today, we will uncover the hidden gem of trading patterns: We explore various indicators and tools to. The m pattern is another classic reversal formation that signals a potential change from a bullish to a bearish trend.